Introduction:

The business strategies of Bang & Olufsen will be analysed in this report, including an external environment analysis of the company. Bang & Olufsen (B&O) is a global luxury lifestyle brand which is specialized in timeliness design and unrivalled craftsmanship of sound devices and video devices (especially television) (Bang & Olufsen, 2019). The company was established in 1925 in Denmark (Bang & Olufsen, 2019). Product portfolios of the brand include sound devices such as speakers and headphones; video devices: only television; and accessories to preserve and carry the devices the brand makes (Bang & Olufsen, 2020) as the case study of B&O revealed that the brand was listed among the top 20 cool brands at serial no 4. However, Bang & Olufsen is no more listed among top 20 cool brands (Superbrands, 2019). Other globally more reputed brands, such as Glastonbury, PlayStation, Netflix, Nike, Adidas etc., have grasped the upper position in the top cool brand list (Superbrands, 2019). This reveals that B&O somehow has failed to maintain the product’s appeal to the customers. This is one of the investigative topics which will be analyzed in this report.

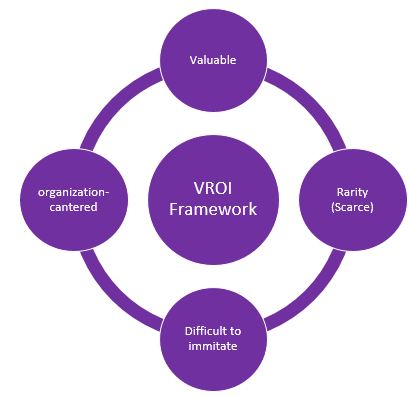

This report is mainly divided into two segments; the first segment will critically evaluate and justify the strategies adopted by the brand, and the second segment will analyse the external and internal forces B&O faces and how it Responses to them. External analysis has applied models such as PESTEL analysis, Porter’s Five Forces model, Industry Life Cycle etc. The internal analysis will use one key model, such as the VRIO model.

You may feel interested to read below blogs:

Tourism strategies for Broadstairs coastal area

External Environmental Analysis of InterContinenal (IHG) Hotels and Resorts

External and Internal Environment Analysis of Nando’s

Unique Selling Point of Toyota

Social Psychology at Organizations

Business strategies of Bang & Olufsen

Rothaermel (2016) revealed that a company could have three levels of strategies: corporate level, business level and operational level. The corporate level is the highest level where strategic orientations are mainly made.

Pole position helped B&O to focus on core jobs: B&O has defined the strategy: Pole Position as having clear goals, a sense of urgency of the goals and proper teamwork with clearly assigned tasks to team members (Case Study). This is a corporate strategy. At the business level, B&O has clearly specified that it would focus on core areas (sound and audio devices) rather than many areas. As per the business strategy, it focused on making timeless design and unrivalled craftsmanship in the sound devices and televisions. It helped the company significantly to build capabilities in the core areas. Schilling, and Shankar (2019) found that clearly outlined teams and distribution of work play great roles in any organization to energize the workforce because they know what their duties are. As a result, teamwork was excellently performed at B&O because the employees knew their duties and job details. A clear vision and helping the employees understand the importance of the vision also played an important role in collaborative teamwork.

Focus on fewer category products: Another corporate strategy of B&O was to focus on core products of audio and video devices (Case Study). At business level strategies, they shortened product portfolios too much limited to some types of speakers, headphones, television, and finally accessories to preserve and maintain the products it makes (Bang & Olufsen, 2020). As a result, the brand discarded manufacturing mobile phones, MP3 and DVD players. Focusing on a few categories will undoubtedly help companies to build capabilities and product workmanship that will differentiate a brand from competitors. However, Hitt, Ireland, and Hoskisson (2012) argued that focusing on core areas could be suitable at an early stage of business; but a company should diversify the business portfolios in different segments for sustainable business growth and perspectives. The current portfolio of the brand B&O reflects that it is still sticking to the plan of a few products whilst the competitors (such as Sony, Panasonic, LG, Bose) expanded their portfolios. As a result, B&O is no more listed as one of the brands in the Top 20 Cool brands (Superbrands, 2019). It implies that B&O’s strategic direction was misleading because it lost the market position and market appeal that it had before 2010 while compiling the case study.

Focus on one technological digital platform: Another corporate-level strategy B&O made is that it focused on one technological digital platform to design and manufacture the products (Case Study). At the business level, the brand terminated all different types of technological platforms that it used to use in the past. It also searched the manufacturing business partners that match the technologies with those of B&O. This strategy proved helpful for many reasons. Firstly, it reduced the product life cycle of bringing a product from concept to market. This played the most important role because about 25% of the revenue of the brand came from the new launches in the past 12 months (Case Study). Shortened process life-cycle also helped the brand to keep itself much ahead of competitors because of new products with temple designs and craftsmanship. Secondly, it helped B&O to save the cost saved for not changing the layout of the digital technological platform.

Focus on one global sales organization: A potential corporate strategy of B&O was to emphasize one global sales organization in product selling and distribution (Case Study). At business level strategies, B&O contacted only 1200 stores for displaying and selling the products. However, the brand didn’t take the initiative for online selling before 2010. David and David (2016) argued that a lifestyle brand should seek more and more display centres to outreach the largest number of customers possible. But the initiatives taken by B&O don’t imply that they tried hard to reach large number of customers until recently. At present, B&O sells the products in 522 mono-brand stores, 4782 multiband points of sale and, most importantly active online presence in Europe and in the Americas.

Adjust cost as market demand: Cost always plays a great role in a customer’s buying behaviour. Less manufacturing cost helps the company to charge lower prices to customers. As a result, a number of customers who do not afford luxury lifestyle products will be able to avail their desire for a luxury brand such as B&O.

Global Audio Device Market

Allied Market Research (2020) revealed that global audio devices are dominated by wireless and portable devices for usability on the move, on smartphones and on vehicles. The increasing demand for smartphones has fueled the rising demand for wireless devices. Mordor Intelligence (2020) reported that global demand for wireless audio devices has been on the rise due to a range of applications. However, audio frequency and health-related issues are obstacles to further growth.

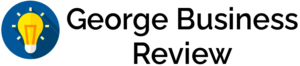

Figure 1: Audio devices global market (Markets & Markets, 2020)

Markets & Markets (2020) revealed that the market was worth $57.3 billion in 2020, and it is projected to increase at a CAGR of 18.60% to reach $134.2 billion in 2025. This implies that the market will grow at a good pace in future.

Mordor Intelligence (2020) reported that Asia Pacific would fuel the growth of the market.

The report revealed that demand of audio devices will highly increase in China, India and in Japan in next 5 years. Above demonstration shows that demand of audio device will increase highly in Asia Pacific regional countries. Therefore, B&O should find sustainable retailers and shops to display their products in these regions.

Above pictogram reveals that Apple Inc. Bose Corp., DEI, Samsung, Senheiser Electronics are considered the key market players in the audio device industry. It implies that B&O is far from being a strong competitor of the industry.

In global television industry, the concept of LCD, LED is no more luring to customers who are now used to learn about Smart TV. Market Watch (2020) reported that Samsung, Vizio, Sony, LG Electronics, Panasonic, Hisense, TCL, and Sharp are the market leaders in the global television industry. It means that B&O is again not in global top competition of TV industry.

Price of a 4K HDR TV at B&O is £6,808 (Bang & Olufsen-1, 2020). On the other hand, same definition television at SONY is only £1420 (Sony Electronics Corporation, 2020). This comparison clearly demonstrates why SONY is an industry leader and why B&O is not even considered a top player in the industry.

External Environment Analysis of Bang & Olufsen

PESTEL Analysis of Bang & Olufsen

PESTEL is an external environment analytical tool which helps a company to analyze the macroeconomic environemnt and helps to compile appropriate strategies (Wheelen and Hunger, 2011).

Political Environment: Political issues such as BREXIT affects the access of B&O in the UK. B&O should establish a subsidiary in the UK so that its operations are not hampered.

Economic Environment: Economic environment such as COVID-19 will highly affect luxury industry due to decreased purchasing power worldwide. B&O should consider more efficiently manufactured products to reduce price.

Social Environment: Social changes such as increasing use of smartphones, wireless devices and speakers, rise of smart TVs affect companies like B&O (Market Watch, 2020). B&O responded quickly through introducing wireless sound devices and smart TVs.

Technological Environment: A paradigm change happened in technological side: reduced industry life-cycle, continuous innovation features have added to the industry (Mordor Intelligence, 2020). B&O responded though focusing on one technological platform and on a few products to bring more innovative products to market.

Legal Environment: After BREXIT is fully implemented and once B&O attempts to enter Asia Pacific market, it will encounter new legal environment. The company needs to do enough research on the legal requirements.

Ecological Environment: Impact of wireless and sound on health has become a concerning issue recently (Mordor Intelligence, 2020). B&O has offered devices that causes relatively less negative impact on human health.

Competitive analysis of Bang & Olufsen

Porter’s Five Forces Model Bang & Olufsen

This models evaluates the competitive environment in an industry.

Threat of new entrants: It is medium because it is highly capital and research intensive. B&O should enrich its capabilities and resources to reduce the threat even if more new entrants come.

Threat of substitutes: It is very high because customers can retain their existing devices rather than purchasing a new one. However, B&O can insist customers through offers attractive feature and craftsmanship of authenticity.

Bargaining power of suppliers: It is medium because the company has only a 30 manufacturers to produce its products (Case Study). It should have minimum 2 alternatives of similar service providers.

Bargaining power of customers: It is very high because customers have hundreds of options of similar products in the market. To differentiate itself, B&O emphasizes on craftsmanship and authenticity.

Industry Rivalry: It is very high and B&O is not even among top players in the respective industries.

Industry Life-Cycle of Bang & Olufsen

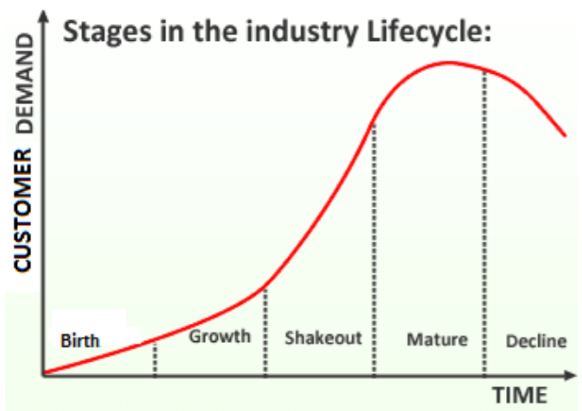

Industry life-cycle explains the different stages of a product through which it goes by (Eden, and Ackermann, 2013).

Wireless sound devices are at the takeout stage in the industry life-cycle because the demand is on rise. Before, it reaches the maturity stage, B&O should introduce a new product to retain the growth. On the other hand, television industry is already on the maturity stage of the cycle. The company should introduce new features to it to lengthen the maturity stage.

Internal forces analysis of Bang & Olufsen:

VRIO Model of Bang & Olufsen:

VRIO model critically evaluates the strength of internal capabilities of a company (Ginter, Duncan, and Swayne, 2018).

Valuable: B&O is a globally recognized brand as manufacturer of luxury, limitless and authentic devices. It also has an established sales and distribution channel. Additionally, it has 900 expert employees. All these are valuable assets which helped B&O to stand itself a globally reputed brand.

Rare: The resources, capabilities, recognition of being manufacturer of timeliness design and unrivalled craftsmanship devices is somewhat rare because only a few manufacturers (such as SONY, Panasonic etc.) have the resources. Additionally, it takes time to build the resources and capabilities (Lasserre, 2017).

Inimitable: The resources and capabilities are not inimitable. This implies that a company with financial capabilities and passion can imitate the capabilities that B&O has. B&O should continuously differentiate itself so that others cannot make 100% copy of B&O.

Organized: The Pole Position strategy and its principles imply that B&O is well-organized in compiling clear vision and objectives, making effective teams to achieve the vision; and assuring and mobilizing the resources to support the teams (Case Study).

Conclusion:

Sound device industry, television industry is highly dominated by high-edge technology, innovative features, commercial usages, portability and smart features connected to smartphones. This report has found that B&O has properly responded to the external forces correctly in many cases such as cost reduction issues, shortening industry life-cycle, and primarily focusing on a few products. However, in long run, it has lost the focus and only maintained those few products which B&O started before 2010. As a result, it lost market appeal and it not no more listed among Top 20 Cool Brands. Television portfolio of B&O is even more concerning that audio devices. It has only a few types of televisions with 4 times higher prices than SONY which offers hinders types of television for different ranges of customers.

References

Bang & Olufsen, 2019. Annual Report. Retrieved from: https://ml-eu.globenewswire.com/Resource/Download/50e6a035-fbe8-4a99-a938-e07d9f8283cd [Assessed on 7 Jun 2020]

Bang & Olufsen, 2020. Bang & Olufsen. Retrieved from: https://www.bang-olufsen.com/en/speakers?_ga=2.215839639.1414125251.1591800323-1588010556.1591800323 [Assessed on 8 Jun 2020]

Bang & Olufsen-1, 2020. Television. Retrieved from: https://www.bang-olufsen.com/en/televisions/beovision-eclipse?variant=beovision-eclipse-55-natural [Assessed on 11 Jun 2020]

Mordor Intelligence, 2020. WIRELESS AUDIO DEVICE MARKET – GROWTH, TRENDS, AND FORECAST (2020 – 2025). Retrieved from: https://www.mordorintelligence.com/industry-reports/global-wireless-audio-device-market-industry [Assessed on 10 Jun 2020]

Markets & Markets, 2020. Wireless Audio Device Market by Product (Speaker Systems, Soundbars, Headsets, Headphones, Microphones), Technology (Bluetooth, Wi-Fi, AirPlay), Application (Home Audio, Consumer, Commercial), Functionality, Region – Global Forecast to 2025. Retrieved from: https://www.marketsandmarkets.com/Market-Reports/wireless-audio-device-market-1275.html [Assessed on 10 Jun 2020]

Market Watch, 2020. Global Smart TV Market 2020 Key Players, Industry Overview, Supply Chain and Analysis to 2024. Retrieved from: https://www.marketwatch.com/press-release/global-smart-tv-market-2020-key-players-industry-overview-supply-chain-and-analysis-to-2024-2020-06-08?mod=mw_more_headlines&tesla=y [Assessed on 11 Jun 2020]

Superbrands, 2019. Official Top 20. Retrieved from: https://www.coolbrands.uk.com/results [Assessed on 9 Jun 2020]

Sony Electronics Corporation, 2020. LED TVS. Retrieved from: https://www.sony.com/electronics/led-tvs [Assessed on 11 Jun 2020]