Introduction:

Insights of the Crude Oil Industry in the UK will be evaluated in this report by presenting different statistics. The global Oil and Gas industry is one of the largest industrial sectors of the world generating around $3.3 trillion annually (IBIS World, 2020). Crude Oil is the main element of oil, gas, and many other petrochemical products. The biggest and dominating manufacturers of oil are the United States, China, Saudi Arabia, Russia, Canada and China. The market size of UK Crude Oil and gas is £21 billion, and the business population is 193 organizations (IBIS World-1, 2020). The industry employs around 32,406 employees in the UK. The key players in the UK Crude Oil industry are BP plc., CNOOC International Ltd., Total E&P UK Ltd etc. IBIS World-1 (2020) also found that average industry growth in Crude Oil declined in the last decade by -7.2%. Maturity of the existing fields and not finding commercially viable sources are the reasons for such a decline in production. This report will have an analytical review of the price changes in the Crude Oil industry in the UK over the period from 2010 to 2020. This will also critically review the economic factors and issues that led to the price changes during the same period. Afterwards, this report will also identify and analyse the government interventions and actions to affect the UK market over the same period. Finally, the report will analyse the immediate and future impacts of COVID-19 on the Crude Oil industry in the UK.

You may feel interested to read below blogs:

Food and Beverage Industry of the UK

Role of a leader and functions of a manager

External Environment Analysis of British Airways

External Environment Analysis of JCPenny

Research Proposal on the Impacts of Discounted Products on Consumer Buying Behavior

Changes in Crude Oil prices in the UK from 2010 to 2020

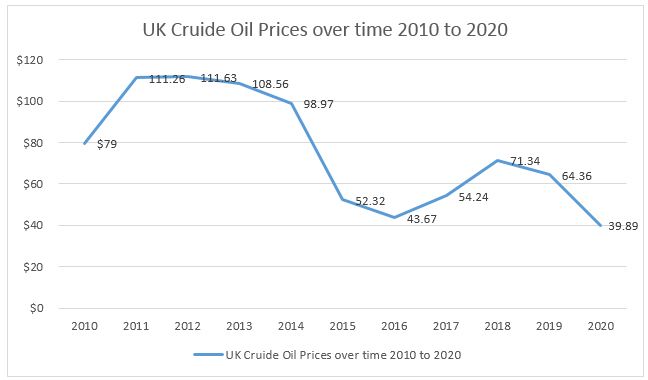

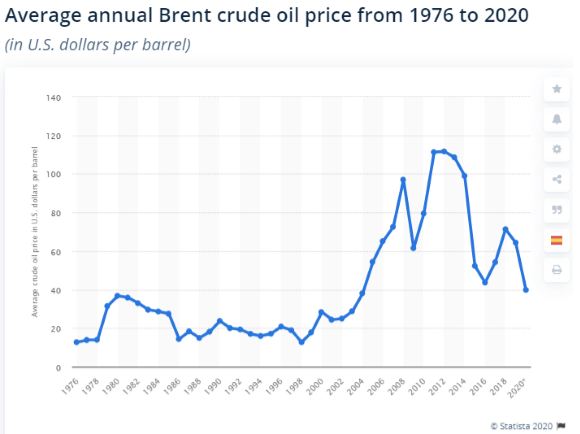

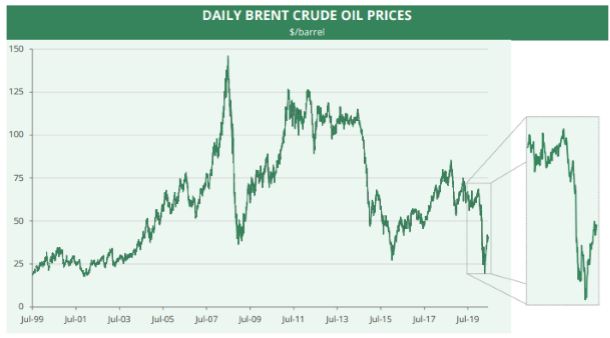

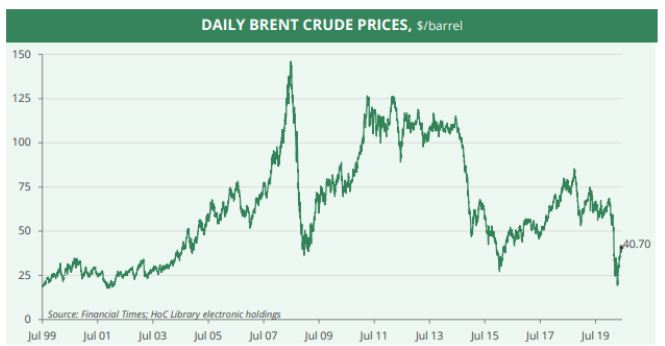

Crude Oil prices in the UK are strongly connected with the oil prices, demand, and supply from the rest of the world. Therefore, Crude Oil prices in the UK do not work in isolation, and the prices in the UK are not determined by the national demand or supply. Figure 1 and the corresponding table have been compiled based on data and graphs as presented in Figures 2 and 3.

| Years | UK Crude Oil Prices over time 2010 to 2020 |

| 2010 | $79 |

| 2011 | 111.26 |

| 2012 | 111.63 |

| 2013 | 108.56 |

| 2014 | 98.97 |

| 2015 | 52.32 |

| 2016 | 43.67 |

| 2017 | 54.24 |

| 2018 | 71.34 |

| 2019 | 64.36 |

| 2020 | 39.89 |

Table 1: UK Crude Oil Prices over time 2010 to 2020

From the sharpest decline of Crude Oil prices at $36/barrel in 2008 following global grate financial crisis, it started to increase after 2009 and reached as high as $79 in 2010. Following two years 2011 and 2012 experienced sharp increase to around $111 in both years. This happened mainly because of increased demand because of Arab Spring which was a major reason for this sharp increase (Bolton, 2020). As the figure demonstrates, Crude Oil price experienced a small decline in demand in 2014 at $98.97/barrel. Dramatically, prices declined sharply in 2015 to half at $52/barrel. Bolton (2020) revealed that poor global growth, lack of confidence among consumers, and increased supply of Crude Oil played important role to decrease the prices. Again the price fell to $43.barrel mainly because of increased supply of Crude Oil from Iran. However, price outlook became optimistic in following two years in 2017 and 2018 when prices increased to $54/barrel and $74/barrel respectively. Increased tension between Iran and the US again increased the Crude Oil price in early January. However, price fell to $25/barrel in April 2020 because of the Lockdowns worldwide to control the spread of COVID-19. It is expected that prices will increase again in coming days soon once countries will ease lockdowns and lives come to normal.

Above figure 4 shows the daily price variations over a long period; however, this report will concentrate from 2010 to 2020. Main feature of above graph is that there is much variations in daily Crude Oil prices even during the period of sharp increase of stable period. For example, 2010 to 2011, prices increased sharply, but above graph shows that there is high variations (sharp rise and decline) in daily Crude Oil prices.

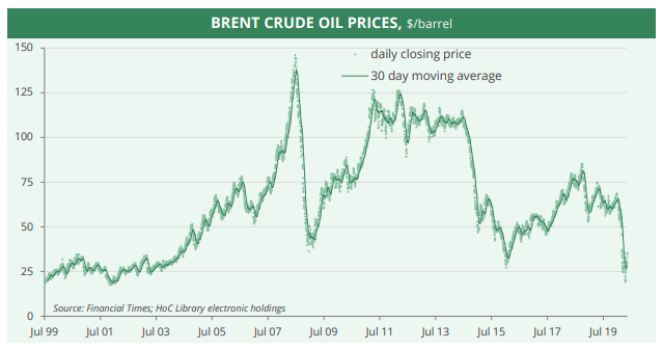

Above figure 3 shows 30-day moving average Crude Oil prices, it is derived from figure 2. It shows that 30-day moving average has demonstrated much smoother prices of Crude Oil in the UK. It also implies that though there is much high-low of prices in days, prices demonstrated stable increase and decrease when considered monthly.

The economic determinants that influences crude oil price

Crude Oil price in the UK does not work in an isolated manner, rather the prices are affected by global events, global demand and supply. Therefore, global events are strongly associated with Crude Oil price fluctuations in the UK. Below section demonstrates global economic determinants that caused Crude Oil prices change in the UK and worldwide.

Consumer confidence and economic activities: Consumer confidence triggers more economic activities because consumers get the confidence on their earning; such confidence is strongly associated with more economic demand and consequently more oil consumption (Kilian & Murphy 2014). Crude Oil is the raw materials for all petrochemical products including oil and gas. Therefore, it is seen that rise in consumer confidence increased the prices of Crude Oil and vice versa. For example, after global economy recovered from the financial crisis, consumer confidence increased, and it led to increased price from less than $40/barrel to $111/barrel only within 1 year. The opposite scenario happens in case of lack of consumer confidence and it led to decreased demand and price fall. For example, after 2014 global economist could not proper forecast global economic trends. This increased suspicious perceptions among the consumers and they reduced their consumption which triggered less fuel consumption. As a consequence, the prices of Crude Oil also declined in the UK after 2014 to 2016.

Demand fluctuation: The law of demand says that higher demand for a product will increase prices of the product and vice versa. Chen, Kuo, & Chen (2010) revealed that demand fluctuations causes the price of Crude Oil to change in the UK and rest of the world. High demand is strongly related to higher prices of oil consequently. In contrast, lower demand causes supply of Crude Oil exceed the demand, as a result, price declines. Mead & Stiger (2015) revealed that the price of Crude Oil declined sharply due to lower demand for Crude Oil in Europe and China. On the other hand, The Fuse (2015) reported that Oil demand in the Europe declined in 2014 due to improvement of fuel efficient vehicles and steeper retail taxes. Thus, this analysis also revealed that improvement of fuel efficiency and tax issues also affected the oil prices and thus Crude Oil prices in the UK and rest of the world.

Supply fluctuation: In line with above law of demand, the law also applies for supply side. At a given time, excess supply exceed the demand in an economy and there remains abundance of goods and services which lead to decreased price (Huang & Wang, 2018). Similarly, opposite happens in case of decreased supply.

Baumeister and Kilian (2014) argued that a sharp price decline of Crude Oil happened in June of 2014 due to increased supply of Crude Oil in the global market. It happened when OPEC countries announced that they would continue their regular production instead of excess Crude Oil production by other non-OPEC countries. This action generated excess Oil in the global market and it led to reduced price of Crude Oil in the UK and in rest of the world as well.

Trade war among countries: Trade war among countries amid political and economic reasons can lead to lack of confidence among customers and they cause price fluctuations of Crude Oil (Ratti, & Vespignani, 2013). Trade War between China and the US caused tension among consumers and countries associated with these two countries. As a consequence, demand of Crude Oil declined sharply in 2019 amid lack of confidence and lack of consumption among customers (Forbes, 2019).

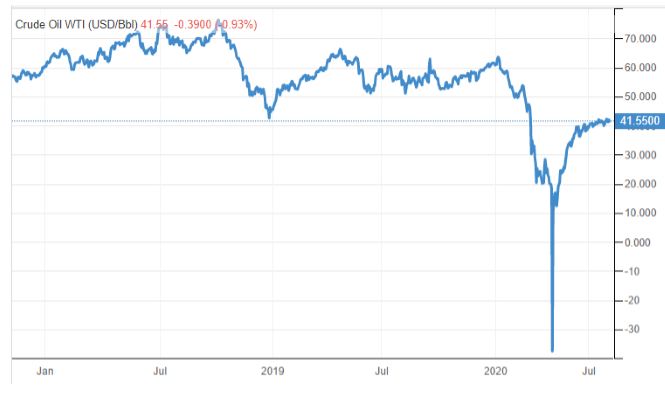

Above figure shows that Crude Oil price declined to $40/barrel in 2019. Forbes (2019) revealed that trade war between US and China is the main reason of such decline in price which has been resulted from decline in demand and confidence among customers in the global market.

Production cost: Zhu et al., (2016) revealed that production cost is a potential economic determinant causing Crude Oil prices to change. Advanced technologies in production makes the production process more efficient leading to reduced oil prices because of abundance of supplies in the market. In contrast, increased production cost raises oil prices in the global market as well as in the UK market. Crude Oil extraction is relatively easy in the Middle East countries and thus cost is less. In contrast, oil extraction is tough and expensive in North America. Thus, more efforts to Crude Oil extractions in the Middle East lead to reduced oil prices. For example, UK economic full sanctions in 2011 created complete ban on Iranian Crude Oil to be traded in the global market (The Washington Post, 2012). Since Crude Oil prices from Iran is lower than non-Middle East countries and since Iran is a potential player in global Crude Oil market; Crude Oil prices increased to $111/barrel in the UK and in rest of the world.

Global Pandemic: Global pandemic: COVID-19 in the UK and the resultant economic consequences happened are temporarily closure of all the business, vehicles, manufacturing and economic activities many of which are related to use of fuel (Nicola et al., 2020). This happened in all the countries of the world. As a result, demand of oil dropped drastically and hence the lad of demand and supply worked: excessive supply decreases prices. As a result, Crude Oil prices declined to $25/barrel in April 2020 (Bolton, 2020).

How UK government affected the UK market over the period from 2010 to 2020

UK economy is world’s 6th largest economy which is mainly dominated by market-oriented economy (Ward & Rhodes, 2014). Such market oriented economy should be free from government interventions, still there are some sectors that UK government interfere. Such government actions and their influences on the UK market are analysed below:

Interest Rate control: Interest rate refers to the bank rate at which people and businesses get loans from banks. Grossman & Woll (2014) revealed that The Bank of England have direct interventions in the interest rate to influence the bank rate in the UK economy. Such actions certainly affect how consumers behave and do purchases.

Figure 9: Bank of England intervenes into the interest rate (Trading Economics-1, 2020)

Above image figure shows that the Government of UK and Bank of England made a dramatic policy change after 2008 towards 2020 through reducing the bank rate from above 5% to 0.5% or less till now. This approach clearly shows that this is government intervention without which such a dramatic decisions would not have been possible. Lovell & Smith (2010) argued that UK government took such decision to increase the tendency among people to borrow more money from banks and to do more consumptions. Such consumption increases economic activities, and as a result, UK economy gets new growth opportunities.

Taxes and duties: UK government has different types of tax and duties policies for different types of products and services.

| Items Name | Tax and duties |

| Alcohol and tobacco | 20% |

| Petrol, diesel, biodiesel | 20% |

| Heating fuel | 5% |

| Standard insurance rate | 12% |

| Visiting and shopping in the UK and live outside UK or EU | Tax-free shopping |

| Energy-saving products (central heating systems, solar panels, wind turbines etc.) | 5% |

Table 2: Different tax and duties in the UK market (Crown Copyright, 2020)

Above table 2 clearly shows that UK government has certain preferences for some industries such as heating fuel which is related to health issues, energy saving products etc. In contrast, it discourages people not to consume alcohol, and tobacco by imposing high tax rates. It also persuades consumers not to adopt conventional forms of transportation using petrol or diesel that pollutes the environment. In both cases, the UK government has imposed 20% taxes. Such tax policies have a certain impact on the market and on consumer behaviour. For example, standard packaging system and high tax rates on tobacco has even increased the prices of even cheap tobacco. Hiscock (2020) revealed that tobacco consumption declined by 20 million sticks in July 2018 when the study was conducted. This clearly shows how price-sensitive cigarette consumers dramatically changed the habits of their behaviour due to government intervention.

Emergency supports to save businesses: Like other countries, the UK government has also taken some quick and urgent actions to save small and large businesses by supporting them with loans to pay their expenses and taxes (Nicola et al., 2020). This has significantly helped businesses to pay their employees and save jobs, thus not worsening the unemployment situation of the country.

Apart from the above, another potential action taken by the UK government is BREXIT. The consequences of such an agreement are known to the businesses and general consumers. As a result, most the business organizations do not feel confident enough and such lack of confidence is not good for investment (Welfens, 2019). Such situations also raises a lack of confidence among customers, and they also feel hesitated and reserved in consumption.

Immediate and future effects of COVID-19 on the prices of Crude Oil

Prices of Crude Oil depend on supply and demand collaboration in the global oil market. In the short term, COVID-19 has limited international flights the movement of all types of vehicles through rationalizing the practices of doing office at home and conducting meetings online (Albulescu, 2020). The new disease has also decreased the global demand for supplies which would require the use of oil in industries. All of the above descried above require the use of oil. Therefore, it is seen that price of Crude Oil will not increase in short term and price will not be as high as before in the long term.

Less consumption and demand leading to price fall: Wang, Shao, & Kim (2020) revealed that the world has seen an unprecedented event of drastic fall of oil consumption globally because countries have applied strict lockdowns which limited the movement of vehicles, many of the offices have made it normal to work from home, international meetings and travels have been made limited and many of the meetings are conducted online. All these issues have direct impact on the oil price and, consequently Crude Oil price, which is the basic source from which all types of petrochemicals and oil extracted. Bolton (2020) reported that Crude Oil price declined as low as $25/barrel. This is the lowest price of Crude Oil since 2009’s global financial depression. From above analysis, it can be seen that there are certain reasons for which Crude Oil prices declined as low as $25/barrel and most can be reasoned as the law of demand and supply.

Price will increase slightly in short-term: Sharif, Aloui, & Yarovaya (2020) predicted that countries will not sustain the present normal of lockdowns for long times; rather they will find ways for a new-normal through mobilizing communication, transportation, production and businesses with necessary measures to prevent COVID-19. Now, most countries have started their daily operation slowly and mobilized their transportation, allowing companies to open businesses in limited scale, international flights have also started in limited scale. As a result, Crude Oil price increased slightly to around $40/barrel in July 2020 (Bolton, 2020). However, this price is not likely to reach the Crude Oil price of 2019’s $65/barrel because there is a lack of confidence among people, which is a big obstacle to increased demand.

In the long term, demand will decline: Ozili & Arun (2020) argued that the world has been introduced to some new situations, such as meetings being conducted online declining demand for airlines and vehicles, office jobs can be done online declining the need for vehicles. All these new-normal will significantly reduce the demand for petrol, diesel, octane, jet fuel, and LNG in the long-term. Therefore, it is predicted that the price of Crude Oil will also be not as high as 2012’s price of more than $100/barrel.

Conclusion

The crude Oil industry is global in nature, the supply and demand combination for oil and gasoline products determine the prices of Crude Oil. Thus, the UK has to purchase Crude Oil based on global Crude Oil prices. It has been found that the world has witnessed huge variations in rise and fall of Crude Oil prices since 2010. Following the global financial crisis of 2008, Crude Oil prices started increasing in 2010 towards 2013 to reach more than $110/barrel. However, COVID-19 in 2020 has drastically declined Crude Oil prices in early 2020 to as low as $25/barrel. Global politics, interrelations among countries, global pandemic, consumer confidence etc. played significant role to affect Crude Oil prices. The government of the UK has taken a range of actions, such as interest rates, and tax differentials among products and services to control the market. The report has predicted that Crude Oil prices will soon increase a little bit since countries have started their now-normal lives. However, prices will not reach 2013’s high prices again because most of the jobs are likely to be performed online.

References:

Albulescu, C. (2020). Coronavirus and oil price crash. Available at SSRN 3553452.

Bolton, P., (2020). House of Commons Library: Briefing Paper. [Online] Retrieved from: http://researchbriefings.files.parliament.uk/documents/SN02106/SN02106.pdf [Assessed date 09 August 2020]

Baumeister, C, and L Kilian (2014), “A General Approach to Recovering Market Expectations from Futures Prices with an Application to Crude Oil,” CEPR Discussion Paper 10162.

Crown Copyright, (2020). Tax on shopping and services. [Online] Retrieved from: https://www.gov.uk/tax-on-shopping/energy-saving-products [Assessed date 12 August 2020]

Forbes, (2019). How The Trade War Impacts The Oil Industry. [Online] Retrieved from: https://www.forbes.com/sites/rrapier/2019/08/25/how-the-trade-war-impacts-the-oil-industry/#2c31d50b5ed2 [Assessed date 11 August 2020]

IBIS World, 2020. Global Biggest Industries by Revenue in 2020. [Online] Retrieved from: https://www.ibisworld.com/global/industry-trends/biggest-industries-by-revenue/ [Assessed date 09 August 2020]

IBIS World-1 (2020). Crude Petroleum & Natural Gas Extraction in the UK – Market Research Report. [Online] Retrieved from: https://www.ibisworld.com/united-kingdom/market-research-reports/crude-petroleum-natural-gas-extraction-industry/ [Assessed date 09 August 2020]

Mead, D., & Stiger, P. (2015). The 2014 plunge in import petroleum prices: What happened? [Online] Retrieved from: https://www.bls.gov/opub/btn/volume-4/pdf/the-2014-plunge-in-import-petroleum-prices-what-happened.pdf [Assessed date 10 August 2020]

The Fuse (2015). Europe’s Oil Import Dilemma. [Online] Retrieved from: https://energyfuse.org/europes-oil-import-dilemma/ [Assessed date 10 August 2020]

Trading Economics, (2020). Crude oil. [Online] Retrieved from: https://tradingeconomics.com/commodity/crude-oil [Assessed date 11 August 2020]

The Washington Post, (2012). Increasing concern over oil prices, Iran. [Online] Retrieved from: https://www.washingtonpost.com/business/economy/increasing-concern-over-oil-prices-iran/2012/01/13/gIQAP98PzP_story.html [Assessed date 11 August 2020]

Trading Economics-1, 2020. United Kingdom Interest Rate. [Online] Retrieved from: https://tradingeconomics.com/united-kingdom/interest-rate#:~:text=Interest%20Rate%20in%20the%20United,percent%20in%20March%20of%202020. [Assessed date 12 August 2020]