Introduction

The terms Direct finance and Indirect Finance will be analysed in this report including the term Financial intermediation.

You may also feel interested to read below blogs:

Marketing Strategies of Zara

Challenges that Businesses in the UK Face

Digital Transformation Strategies of Zara

Food and Beverage Industry of the UK

Consumer Behaviour and Insights in Hospitality Industry

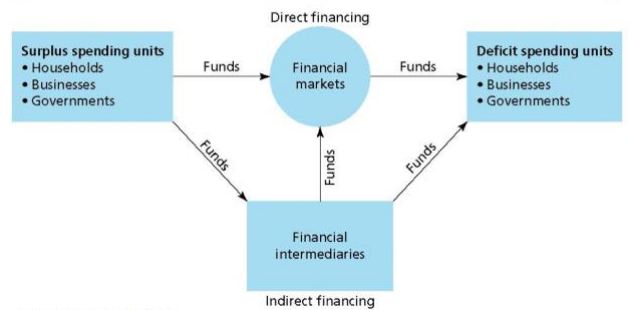

Direct finance versus Indirect Finance

Financing refers to the management of large funds by a person, an organization, or a government entity to make the best utilization of funds (Brigham & Houston, 2012). Finance can be direct or indirect. When a company collects funds directly from the investors or persons such as friends or family instead of financial institutes such as banks, it is called direct financing (Shapiro & Hanouna, 2019). For example, a company can sell shares or stock to individual investors to collect funds in exchange for an agreement to pay dividends instead of interest.

On the other hand, indirect financing happens when a company collects funds from financial intermediary institutes such as banks and insurance organizations (Brigham & Daves, 2012). In such cases, the company needs to pay interest to the lender. For example, a company can borrow funds from a bank, and such payment will cost the company with interest.

The above comparative situation shows that the basic difference between direct financing and indirect financing is the approach of return to the lender. Direct financing does not guarantee a financial return to the investor, loss could also occur, which the investor has to bear. Whilst, indirect financing does guarantee a return to the intermediary institutes with interest rate.

Where is financial intermediation needed?

Financial intermediation refers to the actions of moving funds from entities with excess capital and then providing the funds to the entities who need those (Brigham & Ehrhardt, 2013). Financial intermediary organizations such as commercial banks, investment banks, and investment funds of mutual funds generally play the role of financial intermediation. There are a number of circumstances that made financial intermediation important; these instances are given below.

Firstly, financial intermediation is necessary to efficiently collect excess funds from individual householders or investors at a fixed rate of interest and then invest the funds in businesses efficiently (Moyer et al., 2012). Otherwise, individual investors would not find it convenient and efficient to invest their small savings in a fruitful manner. For example, European Commission (EC) arranged funds and offered two financial instruments for start-ups and sustainable urban development projects (European Commission, 2016). In this example, EC played the role of a financial intermediary and this organization intermediated to make efficient use of funds.

Secondly, financial intermediation is needed to distribute the financial risks over a number of entities and enhance the chance of good returns (Chandra, 2011). For example, Standard Chartered Bank collects savings from individual persons worldwide. The company then makes investments of the funds in different organizations. Such variations and diversification of investment ensure good returns even if a few cases of financial catastrophes happen. The above example shows that financial intermediation reduces the risks of financial catastrophes.

The above analysis shows that financial intermediaries work as a middleman and enhances the efficiency of financial instruments and usages.

References:

Brigham, E. F., & Houston, J. F. (2012). Fundamentals of financial management. Cengage Learning.

European Commission, (2016). Commission launches two new financial instruments to boost investments in start-ups and sustainable urban development. (Online). Retrieved from: https://ec.europa.eu/commission/presscorner/detail/en/IP_16_2448 [Assessed on 24 August 2020]

Moyer, R. C., McGuigan, J. R., Rao, R. P., & Kretlow, W. J. (2012). Contemporary financial management. Nelson Education.