Introduction

How MNCs Enter New Markets will be evaluated in this report by applying internationalisation strategies on British Petroleum (BP). Entering a new foreign market requires extensive research on the market, the customers, competitions and external economic and political forces. This report is from the perspective of entering an MNC into a new market. The selected MNC is British Petroleum (BP) which is a UK-based fuel manufacturer, marketer and seller. In this report, BP wants to enter the Bangladeshi energy market because the demand for gas, and oil is on the rise in this market, and BP finds it as a potential market for future growth (The Business Standard, 2020). This report will analyse the domestic market and target foreign market. Additionally, obstacles to foreign market entry and their solutions will also be advised.

You may feel interested to read below blogs:

Introducing European Economic Community (EEC/EU)

Pros and cons of contract manufacturing

Why pharmaceutical companies go for contract manufacturing?

Dunning (2012) revealed that the most potential reason for MNCs’ internationalization is the growth potential that MNCs need which they can implement by expanding the business on a larger horizon. Going international is the most prominent approach. Market opportunities in foreign locations; looking for economies of scale; and finally, full utilization of the innovations made by the companies. On the other hand, Verbeke (2013) argued that MNCs face a number of challenges and issues while doing the internationalization process.

Why MNCs Internationalize:

Newmarket and more sales: Doz (2011) revealed that the most potential reasons for MNCs going international are new market opportunities and more sales growth. Firms see that there is a huge demand for their products and services in a foreign market or there is no potential competition in the foreign market, which influences them to take first mover advantage in the market. For example, Sony was established in Japan in the 1940s, the company found that its products and quality had a huge demand in other markets, which demonstrated optimistic sales and business growth. Such issues inspired Sony to internationalize the business across almost all the countries in the world. The above analysis shows that the opportunities for new markets and more sales inspire companies to go international.

Utilization of innovation and creativity: Killing (2012) has found in their research that companies go international because they have innovation and creativity in their products and services, which are not available in other countries. As a result, companies take the decision to internationalize their business with the hope of making their innovative products and services to those customers. Apple is an excellent example which aimed to internationalize the business because it gained much respect and dignity in its home market, which inspired the company to expand the business internationally (Linden, Kraemer, and Dedrick, 2009). This can be seen that exclusive designs, innovative features and attractive designs have inspired Apple to expand the business internationally.

Economies of scale: Dunning (2012) argued that experiencing economies of scale is a potential reason why firms want to internationalize their business. Companies want to achieve economies of scale effect in manufacturing, procurement, design and development, distribution and in sales and marketing. Economies of scale are possible when a firm can make more goods at lower costs; in such a situation, expanding the business internationally is the only way to achieve economies of scale. British Petroleum (BP) is an excellent example in this regard. Producing fuel is a heavy investment-intensive job which certainly requires economies of scale. As a result, BP has expanded its business internationally to seek economies of scale effect in manufacturing, procurement, design and development, distribution and in sales and marketing.

Growth Option: Beamish (2013) stated that firms look for different strategies as part of their growth option, and internationalization of their business is one of the most prominent ways to seek growth. Emerging economies such as China, India, Bangladesh, Pakistan, and Brazil play a great role in this regard. Welch et al. (2011) argued that economic growth in emerging economies plays a great role in expanding global business, and companies want to take part in the growth process of emerging economies. Chinese Smartphone Companies namely Xiaomi, expanded their business extensively in the mentioned emerging economies only because the purchasing capability of people in these economies is increasing. As a result, the company will be able to grow its business being a part of these emerging economies.

Diversification of business and risks: Bordo and Helbling (2011) stated that business organizations should not put all the investment in one business or in one market; rather, diversification is necessary to share the risks in many places. Firms go international to diversify their risks and business to save the business from political risks, climate risks or economic risks because failure in one market will not ruin the business because it has a presence in multiple locations. Huawei is another example which diversified its business in different sectors and in different geographic regions. The company has businesses in the field of network technologies and hardware and in smartphone devices in the EU, North America and Asia. Recently, Huawei faced restrictions from the EU and US because of some political issues (Fortune Media IP Limited, 2020).

Ease of internationalization process and government incentives: Birkinshaw, Brannen, and Tung (2011) argued that countries had eased the internationalization process terms and conditions, economic zones are established, and governments are offered financial and technical benefits for companies to attract investment in their countries. All these issues have eased up the internationalization process, which has inspired firms to go international. Such financial incentives, such as the reduction of taxes for the first 10 years of establishment or allocation of especial economic zone with all infrastructural facilities, have widely inspired companies to make investment in those regions. As a result of these incentives and ease of business, firms go international.

The above analysis clearly shows that firms go international not only because of growth, sales need and economies of scale needs; but also because different governments offer incentives and advantages for doing business in their countries. As a result, companies internationalize.

Challenges MNCs face while internationalizing:

MNCs operate a business in multiple countries, and as a result, they face various types of macroeconomic, global economic and political complications and differences (Clarke, Tamaschke, and Liesch, 2013). These issues and complications are generally out of the control of any MNCs, thus, they need to cope with the macroeconomic and political issues. This section has identified a few challenges and issues faced by MNCs.

Language and cultural difficulties: Glavas and Mathews (2014) stated that language and cultures are different across countries in the world; thus, MNCs face differences when they expand their business to a new market. Language and culture are integrally relevant to any business because companies need to communicate with people and make marketing communication messages. Unknown cultures and languages will create obstacles in marketing and branding communication. These will also hamper regular communication with other stakeholders in the new country. However, the problem can be overcome by hiring local people knowing the language and culture nicely. This step with solve the problem, and Language and cultural difficulties will no longer be any problems.

Facing local competition: Strange and Zucchella (2017) found in their research that local competition is always intense, and this poses a major obstacle for MNCs entering an international market. MNCs will find it difficult to compete with local giants because these domestic companies know the market, customers, norms of doing business and culture know far better than MNCs. Therefore, MNCs find it difficult to compete with them and make a good place in the market. However, a prominent approach to solve this problem is to conduct market research either by exporting to the target foreign market, having a franchisee in the market or entering the market through a joint venture which knows about the market already.

New tax codes and compliance complications: Ghauri, Grønhaug, and Strange (2020) analyzed that tax codes, vat and tariff regulations are different for foreign companies. The authors also argued that rules of doing business vary across countries; all these issues pose severe obstacles for MNCs to internationalize their businesses. For example, China has different sets of rules for making business, tax codes, vat, and tariff regulations. Thus, a US company will face difficulties learning the new codes of doing business. However, the US MNC has the option to overcome the stated problem by hiring a business lawyer to help the company learn domestic rules and regulations.

Risks in the supply chain: Supply chain in the new market also poses serious threats for the MNCs entering a new market (Majaro, 2013). The risks are related to new suppliers, their quality, payment methods and security-related issues. Therefore, MNCs should be very much careful while dealing with foreign countries. For example, if Uber enters a new market such as Brazil, the market is completely different from its home market: the USA. Thus, Uber should be very much careful about the new supply chain, payment terms and conditions, and code of conduct with business partners in the new markets.

Operational risks with new employees: Rabanal et al. (2011) found that MNCs also face operational difficulties with newly recruited employees in international operations. For instance, new employees will not know a new culture and new code of conduct, and most significantly, new employees might leak potential information to domestic competitors. The possible way to avoid such a problem is that MNCs should appoint expatriates in sensitive positions so that resource intelligence is not revealed to domestic employees.

Global politics: Cravino and Levchenko (2017) revealed that global politics are reasons for which many MNCs face difficulties. For example, the ongoing trade war between the US and China is an excellent example of which companies in both countries cannot operate a business in a free market economy. As a result, both countries are suffering. One prominent solution to this problem might be to register the company in the local market so that the host country treats the company as their domestic company. This would solve the problem of global politics.

Economic Instability: Alcácer, Cantwell, and Piscitello (2016) stated that economic stability in host countries for certain reasons also affects MNCs. For example, COVID-19 has created a unique situation by stopping world business, and as a result, most of the nations in the world are hit hardest. In such situations, MNCs should revise their business strategies in such a way that they can sustain economic inactivity while people purchasing power declines.

How an MNC can enter an international market

MNCs need to analyse the domestic market:

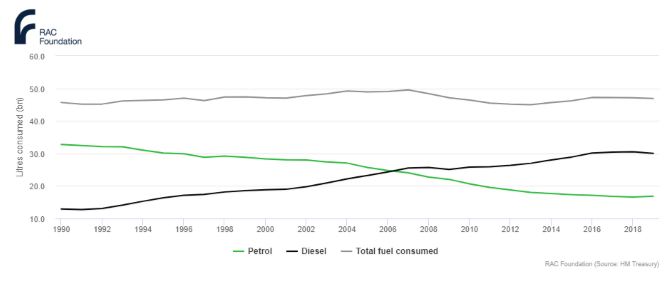

UK is the domestic market of BP. UK gasoline and diesel sales in 2019 were a total of 46.5 billion litres which is broken down into Petrol 16.20 billion litres, and Diesel 30.30 billion litres (RMI, 2020). On the other hand, the country produced about 52.2m metric tons of crude oil and NGLS in 2019 (Statista-1, 2020).

Figure 1: Demand of fuel in the UK over time (RAC Foundation, 2020)

The above figure clearly demonstrates that the demand for fuel in the UK is relatively stable at around 48 billion litres over the period of 28 years from 1990 to 2018 (RAC Foundation, 2020). However, the demand for diesel increased gradually, and the demand for petrol decreased slowly over time.

Vătavu et al. (2018) revealed in their research that 98% of the production of fuel in the UK comes from offshore production facilities. This implies that the country has significant control and technological know-how in fuel manufacturing. As a result, a number of domestic manufacturers developed their capabilities in the home market.

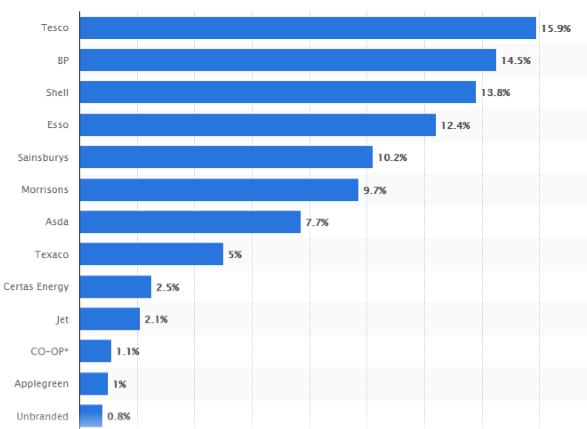

Above figure clearly shows that the UK fuel market is clearly dominated by home fuel manufacturers. Tesco is known for groceries chain worldwide, paradoxically, this organization is leading the UK fuel market in terms of market share with 15.9%. Whilst, BP is globally known for being an expert in extracting, manufacturing and marketing fuel products, this organization is placed second with a 14.50% market share.

Strategy to internationalize:

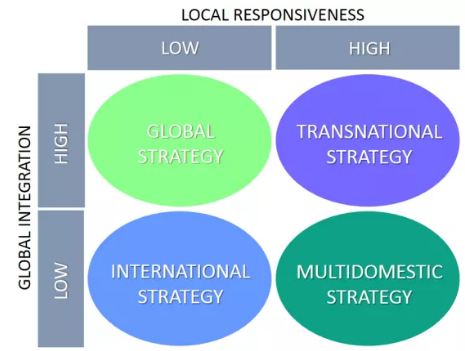

Peng (2016) revealed that an MNC has different options of strategic orientations based on different levels of local responsiveness and global integration.

Among all the strategic directions with different levels of global integration and local responsiveness, transnational strategy promises the best outcome for BP to internationalize its business in Bangladesh. Peng (2016) revealed that a transnational strategy is suitable for companies which need to acquire higher efficiency upstream of the supply chain and more responsiveness downstream of the supply chain. BP needs to acquire higher efficiency in fuel extraction and manufacturing; on the other hand, the company needs to be responsible for marketing and promotional initiatives. Therefore, a transnational strategy is the most suitable option for BP.

MNCs need to conduct Environmental analysis of selected foreign markets:

PEST analysis refers to the analysis of the political, economic, social and technological environment. PEST analysis of Bangladesh has been stated beneath:

Political Environment: Political environment of Bangladesh is restless and the country is dominated by two political parties with abundant agendas. Political violence and strikes take place in the country and often hamper the transportation of goods time (Hussain, 2013). As a result, BP will face difficulties because of the restless political environment.

Economic Environment: Bangladesh is a country with lower-middle income, and the economy of the country is going rapidly. Garment sector is the 2nd biggest income source of the country Hossain, Suvo, and Islam, 2011. This factor will make BP highly profitable because the company will get orders of huge amount of diesel for the garments.

Social Environment: Networks, connections and grouping are a significant part of Bangladesh (Hussain, 2013). Therefore, BP has to make strong connections with its buyers. Bengali is their language, but English is spoken hugely. As a result, BP will be able to communicate in its own language.

Technological Environment: Bangladesh is technology-oriented, and mobile phone coverage in the country is very high (Rahman et al., 2017). The country also has superfast broadband. All these refer that BP will be able to utilize the technology and communicate with buyers easily.

Mode of entry that MNCs can adopt:

There are different types of market entry modes that BP can apply. These are licensing and franchising, acquisition, exporting, partnering, foreign direct investment and others (Couturier, and Sola, 2010).

Exporting ensures fast entry with lower risks. Licensing also ensures low risks, low costs and fast entry. Partnering and strategic alliance make sure that companies invest jointly, which reduces and have fewer risks because partners also bear the risks. Acquisition needs higher cost because companies achieve a local company. And foreign development business (FDI) is the way of establishing a formal business in a foreign country (Ahi et al., 2017). BP should conduct FDI for Bangladesh. BP will have a formal business set-up, such as build own factory, sales offices and distribution networks in Bangladesh. BP will have direct ownership there, which will provide a high degree of control of the operations and the company will be capable of knowing their customers in a better way including a competitive environment.

Challenges that MNCs face target market:

BP may face different types of problems when they establish a business in Bangladesh. Because of the political violence and strikes, BP may not be able to transport their lubricants to the fuel stations timely (World Bank Group. 2020). Secondly, the language and culture of Bangladesh are different from the official language of BP. Therefore, it will face difficulties. It can solve this problem by hiring local people. Thirdly, there are infrastructural problems, and electricity problems (World Bank Group. 2020). Again, BP can solve the problems by establishing the facility in a specialized economic zone where there are fewer problems.

Leadership qualities that MNCs need for new entry:

Leaders of the new subsidiary of BP should demonstrate excellent leadership capabilities. The company should relocate expatriates in Bangladesh operations to keep stringent control of the operation and to teach others about how to lead a fuel company. However, leaders should provide enough independence so that employees can make their job-related decision. Leaders of BP should have good relations and knowledge about entry strategies. They can make communication with the Bangladeshi government through British High Commission located in Bangladesh.

Bangladesh offers expedited services in specialized economic zones (EPZs) and financial benefits for foreign companies (World Bank Group. 2020). BP should know all details and ensure proper utilization of relevant benefits.

Conclusion

BP is a global leader in oil and gas exploration, manufacturing, and sales and marketing. Though this is a global leader at home, Tesco Fuel is the leader. Research has found that Bangladesh promises excellent economic growth in future and thus is a good market for BP. The company should adopt FDI to enter Bangladesh.

References

Alcácer, J., Cantwell, J. and Piscitello, L., 2016. Internationalization in the information age: A new era for places, firms, and international business networks?

bdc, 2020. Entrepreneurial potential self-assessment. Retrieved from: https://www.bdc.ca/en/articles-tools/entrepreneur-toolkit/business-assessments/pages/entrepreneurial-potential-self-assessment.aspx [Assessed on 9 June 2020]s

Fortune Media IP Limited, 2020. Europe opts against an outright Huawei ban, echoing the U.K.’s defiance of Trump. Retrieved from: https://fortune.com/2020/01/29/eu-no-huawei-ban-uk-defiance-trump/ [Assessed on 6 June 2020]

RMI, 2020. The UK Retail Road Fuels Market 2019. Retrieved from: https://www.ukpra.co.uk/en/about/facts-and-figures [Assessed on 7 June 2020]

RAC Foundation, 2020. UK petrol and diesel consumption. Retrieved from: https://www.racfoundation.org/data/volume-petrol-diesel-consumed-uk-over-time-by-year [Assessed on 8 June 2020]

Statista-1, 2020. Fossil fuel industry in the UK – Statistics & Facts. Retrieved from: https://www.statista.com/topics/4845/fossil-fuel-industry-in-the-uk/ [Assessed on 7 June 2020]

Statista-2, 2020. Brand market share of motor fuel sold in the United Kingdom (UK) 2019. Retrieved from: https://www.statista.com/statistics/312071/motor-fuel-market-share-by-brand-in-the-united-kingdom-uk/ [Assessed on 8 June 2020]

The Business Standard, 2020. Bangladesh to double its fossil fuel imports in a decade. Retrieved from: https://tbsnews.net/bangladesh/energy/bangladesh-double-its-fossil-fuel-imports-decade-81778 [Assessed on 8 June 2020]

World Bank Group. 2020. Boing Business Bangladesh. Retrieved from: https://www.doingbusiness.org/content/dam/doingBusiness/country/b/bangladesh/BGD.pdf [Assessed on 9 June 2020]