Introduction

Internal External and Competitive Environment of Domino’s Pizza will be evaluated in this report by applying appropriate theories and models. Organizational strategies critically analyse the internal and external general and competitive environment of a business and suggest a company about possible strategic directions to achieve business objectives. This report has critically audited the internal and external competitive environment of Domino’s Pizza, a US-based Pizza and food restaurant chain with a presence in 17,000 locations; and 290,000 employees, including franchisees (US Securities And Exchange Commission, 2019). The report has also provided strategic directions for Domino’s Pizza.

You may feel interested to read below blogs:

Business strategies of Bang & Olufsen

Internal Environment Analysis of Toyota

External Environment Analysis of Toyota

Risk Management at British Airways

Macro Analysis of MC Donald’s

External Environment Analysis of Domino’s Pizza

PESTEL analysis of Domino’s Pizza

The PESTEL model assesses the external environment of a company.

Political Environment: Political environment of the UK and Ireland greatly affects the business operations of Domino’s Pizza. The UK has active democratic political practise in place, stable business practices, excellent business rank and business-friendly laws and legislation (Hamilton, and Webster, 2018). Doing Business report revealed that the UK ranked 8th globally in terms of easiness of doing business (Crown, 2020). It takes only 3-4 weeks to get a license template for opening a new outlet for Domino’s. It implies that business has become lot easier in the UK.

Economic Environment: UK economy is the 5th strongest country on the basis of its GDP, and the GDP was €2,523,314 million in 2019 (Country Economy, 2019). It refers to the financial stability of UK people, and it is one of the key factors that makes Domino’s highly profitable in the UK because people of the UK can afford their foods easily. As a result, the restaurant generated 98.8 million before tax and is forecast to increase its sales more in the UK (Case study).

Social Environment: People of the UK are becoming more health conscious and many people avoid Domino’s because of the effect of their fast food and drinks. The company has taken some steps to bring health-conscious customers back to them. For instance, Domino’s has manufactured Domino golden sugar, which is less processed and contains more minerals than white sugar (Food Dive, 2020). It will attract customers who avoids Domino’s drink for the effect of sugar.

Technological Environment: Domino’s has utilised technological advancement properly and it helped them to ensure outstanding growth. For example, Domino’s invested 10 million to improve the new platform for e-commerce, and it helped them to increase online sales by about 8.8% (Case study). Among the total sales of the UK, 82% of sales are made online and it refers to the positive impact of technological advancement on Domino’s. It ensures home delivery online and customers can enjoy food at the place where they want.

Ecological Environment: Domino’s have taken solar strategy for pizza production in order to reduce global pollution that is created by their production (Sustainability Matters, 2019). Renewable energy solutions will help them to make sure of their sustainability and safety benefits. It will also increase its reputation among customers because Domino’s is contributing to saving the environment. As a result, customers will respect Domino’s and will maintain repurchase by being more loyal.

Legal Environment: Domino’s maintain all the rules and regulations of the UK to operate which helps them to execute their business more efficiently. They maintain food and health safety law and employment laws that help them to avoid the interference of government or regulatory bodies. For instance, Domino’s ensure average wages for employees and maintain an employee betterment programme. As a result, 81% of employees of Domino’s proud to work there and deliver outstanding customer service (Case study). It increases the demand for restaurants in the UK and they become more profitable.

Internal resources and capabilities of Domino’s Pizza

SWOT analysis of Domino’s Pizza UK

| Strength | Weakness |

| Domino’s Pizza is an S&P 500-rated company which is represented as one of the best corporations in the US (S&P Dow Jones Indices LLC., 2020). Moreover, the brand value of Domino’s is calculated as $7,120M (Brandz, 2020). Clearly, the above data implies that brand recognition has enabled Domino’s to dominate the world pizza and fast-food market through the system and in-store sales (Case study). Domino’s has 1,184 great-looking stores in UK and Ireland with a high level of online penetration (Case Study). 88% of the customers are repetitive, which represents high brand re-call (Case Study). The above statistics imply that Dominos has good coverage with excellently decorated and service-oriented outlets in the UK. As demand in the UK grew, Domino’s opened 28 new stores in the country (Case Study). | Domino’s has experienced inefficiencies in its operations management in all respects. As a result, the company has been forced to reduce global operations (The Guardian News and Media Ltd., 2020). Such inefficiency is most likely to negatively affect UK operations as well and it implies that UK operations is also inefficient. The company has also experienced little growth in the UK market in terms of sales, it grew by 3.9% in 2019 whilst 28 more outlets increased at the same time (Case Study). This means that Domino’s is suffering from a lack of sales growth. |

| Opportunities | Threat |

| Sales from franchisees increased to £1,210.9m in 2019 in the UK from £1,155.4m in the previous year (Case study). Domino’s can more aggressively enhance system sales in UK and Ireland gradually. Domino’s Pizza emphasizes promoting a healthy diet by selecting the best ingredients, using less fat and sugar, evaluating the sources of supplies and applying workplace hygiene (Dominos, 2020). | Domino’s is like to face poor qualities at franchisee operation because the company doesn’t have direct supervision of the franchisee stores around the world. Thus, degradation of quality in all respect will affect the brand value of the company. Changing eating habits will also pose a threat to Dominos. Covid 19 has changed the scenario of store based retail food chain. No customers would visit stores for food due to the deadly infectious disease. |

VRIO analysis of of Domino’s Pizza

This model helps to critically assess the value of resources and capability of a company (Barney and Hesterly, 2010).

Value: The value of resources and brand reputation is of great importance for Domino’s because they are sources of competitive advantage for the company. However, Domino’s should strive to increase its brand value.

Inimitability: The resources are imitable because any company with financial capability can build food chain stores. However, brand value and experience are not imitable overnight because these resources take years to build (Ansoff et al., 2018).

Rarity: Infrastructure, capital resources etc., are available resources; whilst experience, recipes, brand image, and global network of franchisees are rare resources (Wheelen et al., 2010). Domino’s should build capabilities and resources which are of great value and rare, such as secret recipes of food.

Organization: Domino’s has a global network of operations which has created a competitive advantage for the company.

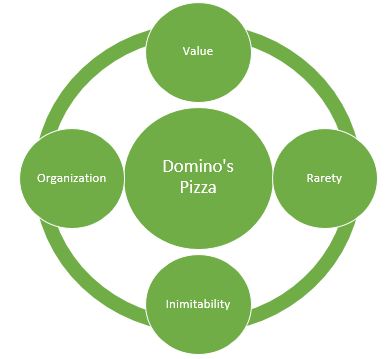

Value Chain Model of Domino’s Pizza

The value chain model shows different stages of complete operations in which values are added (Freeman, 2010).

Support activities such as infrastructure, HRM, technology and procurement help Domino’s add value to the operation. Domino’s developed a mobile-based App which was downloaded 26.6m times worldwide, and people use that to place orders (Case study). However, Domino’s should act more proactively to improve quality parameters around franchisee stores.

Primary activities such as logistics, operations, marketing and sales, and services add value to Domino’s. The company provides supplies and materials to franchisee stores worldwide (Case study). It should also take active part in marketing and sales globally to enhance brand recognition.

Domino’s Competitive environment in the UK

Porter’s Five Forces Model of Domino’s Pizza

Porter’s five forces model is one of the most effective frameworks for analysing the competitive environment of Domino’s. The model is analysed below:

The threat of new entrants: Weaker: Domino’s business maintains the differentiation of their foods by investing in R&D, and it encourages customers in the UK to repurchase their food (Andri, and Zulfebriges, 2019). The demand for their food makes Domino’s capable of selling 19,860 UK pounds weekly. The brand reputation of Domino’s is high, and new entrants will not be capable of easily replacing their brand in UK and Ireland markets. New entrants will face difficulties in entering the market because of the tough laws of the UK and Ireland. All these factors make the threat of new entry weaker for Domino’s.

The threat of substitutes: Average: The threat of substitutes is also lower because there are very few restaurants that provide quality foods like Domino’s, and it attracts health-conscious buyers toward the restaurant. Therefore, the sales of Domino’s reached 2.8 million pounds in the year 2019 (Case study). Few substitutes for Domino’s food are available, but some of them provide average-quality food at a higher price, and some provide lower-quality products with lower prices. Customers who are budget-conscious go to local restaurants to have food at a lower price. Domino’s can capture the customer base by providing discounts or attracting offers. As a result, the revenue of the restaurant will be higher.

Bargaining power of suppliers: Weaker: The bargaining power of suppliers is also lower than Domino’s (Praxedes, 2016). There are many suppliers who provide the raw materials that the restaurant needs and the switching cost is lower. These suppliers belong to small businesses and businesses that deal with Domino’s to help them maintain growth. The company invested 180 million pounds in their suppliers in order to purchase raw materials. Suppliers do not bargain for the price and stay loyal to Domino’s to maintain their own business growth.

Bargaining power of buyers: Weaker: There is less number of restaurant brand that delivers pizza and other delicious and healthy food like as Domino’s (Kim, 2015). It indicates that customers have fewer options to choose and it makes their force weaker to the company. Domino’s has 1,184 outlets in UK and Ireland to ensure that customers of the country get their product on hand and buyers visit their restaurants after getting their service near their hand (Case study). Buyers want healthy and delicious food, and Domino’s maintain the demand of customers. Therefore, buyers are ready to pay a higher prices for the quality food Domino’s provides, and it refers to the weaker force of buyers.

Competitive rivalry: Average: Pizza Hut, MC Donald’s, Burger King, Starbucks, KFC, and local restaurants are the key competitors of Domino’s in the UK (Wenji, 2019). Competitors of Domino’s maintain high differentiation of products that helps them to maintain the demand for its foods within the competitors, but the companies are diverse, and the uniqueness of the competitors makes their position stronger. Domino’s should focus on attracting new customers from competitors by bringing more delicious foods which are more differentiated. It will attract new customers and maintain the existing customer base because they will get unique products from Domino’s.

Strategic options and directions Domino’s future growth

Porter’s Generic Strategies for Domino’s Pizza

This model provides a company with different strategic directions of focus (Rothaermel, 2016). This portion has evaluated two strategic directions from the below model which Domino’s should follow.

Cost Leadership: Given the economic lockdown globally due to COVID-19, people globally have less purchasing power because of economic inactivity. Therefore, Domino’s should emphasize cost reduction, efficient production facilities and efficiency in every aspect of operation so that people can buy more pizzas at fewer prices. This will be of great value not only for UK operations but also for global operations where franchisees operate their business.

Differentiation: Apart from being cost leadership, Domino’s should also focus on differentiation. This is called being differentiated through cost efficiencies. This will, on one hand, will increase the number of customers and brand value, and on the other hand, it will help to attract new customers and ensure more customer penetration. If Domino’s is able to offer differentiated menus, products and pizzas, customers globally will increase. For example, Domino’s can introduce sugarless juice and pizza with all-natural ingredients. This is a differentiation strategy, and it will attract all health-conscious customers around the world. Domino’s will earn more franchisee fees and a global reputation.

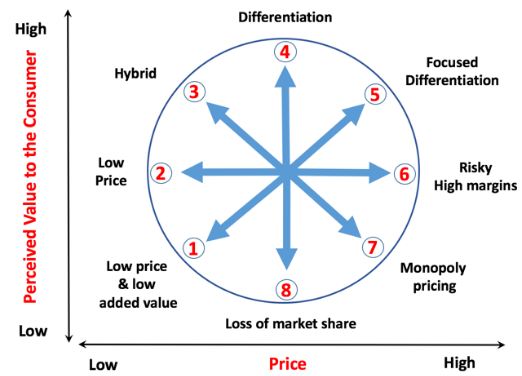

Bowman’s Strategic Clock for Domino’s Pizza

This model shows how a company should position itself to the perception of customers in terms of price and perceived value to the customers (Hitt, Ireland, and Hoskisson, 2012).

The above figure shows different strategic positions a company can adopt. Given the strategic direction is given in immediately above section (cost leadership and differentiation selection), Domino’s should stand somewhere in between differentiation and low price: this is a hybrid strategy (Ansoff et al., 2018). This implies that the price will be medium, at the same time, Domino’s will strive to increase customers’ perception towards the brand value of the company through differentiation. This strategy goes completely in line with two strategies selected at Generic Strategies.

Conclusion

Domino’s Pizza has faced a severe competitive external business environment globally and in the UK, thus, it has been forced to decline global operations. Such operational inefficiency has also been reflected in Domino’s UK operations, where sales have increased only by a bit more than 3% whilst stores increased by 28. Domino’s should emphasize more on operational efficiency, differentiation and cost minimization through being efficient.

References

Brandz, 2020. Domino’s Pizza. Retrieved from: https://www.brandz.com/articlenew/dominos-pizza [Assessed on 15 May 2020]

Country Economy, 2019. GDP improves in United Kingdom. Retrieved from: https://countryeconomy.com/gdp/uk [Assessed on: 15 May 2020]

Crown, 2020. UK rises to 8th on World Bank’s ‘Ease of doing business’ index. Retrieved from: https://www.gov.uk/government/news/uk-rises-to-8th-on-world-banks-ease-of-doing-business-index [Assessed on 15 May 2020]

Domino’s, 2020. Domino’s 101: Fun Facts. Retrieved from: https://biz.dominos.com/web/public/about-dominos/fun-facts [Assessed on: 15 May 2020]

Freeman, R.E., 2010. Strategic management: A stakeholder approach. Cambridge university press.

Food Dive, 2020. Domino goes for the gold with its new sugar product. Retrieved from: https://www.fooddive.com/news/domino-goes-for-the-gold-with-its-new-sugar-product/557054/ [Assessed on: 15 May 2020]

Dominos, 2020. Corporate responsibility. Retrieved from: https://corporate.dominos.co.uk/healthy-eating [Assessed on 15 May 2020]

Sustainability Matters, 2019. Domino’s implements solar strategy for pizza production. Retrieved from: https://www.sustainabilitymatters.net.au/content/energy/case-study/domino-s-implements-solar-strategy-for-pizza-production-1082962212 [Assessed on: 16 May 2020]

S&P Dow Jones Indices LLC., 2020. S&P 500. Retrieved from: https://us.spindices.com/indices/equity/sp-500 [Assessed on 14 May 2020]

The Guardian News and Media Ltd., 2020. Domino’s to pull out of Nordic countries and Switzerland. Retrieved from: https://www.theguardian.com/business/2019/oct/17/dominos-to-pull-out-of-scandinavia-and-switzerland [Assessed on 15 May 2020]

US Securities And Exchange Commission, 2019. Domino’s Pizza, Inc. Retrieved from: https://www.sec.gov/Archives/edgar/data/1286681/000119312520042675/d796357d10k.htm [Assessed on 14 May 2020]