Introduction

The roles of Management Accounting Systems will be analysed in this report. Management Accounting SystemManagement of accounting is the critical analysis and evaluation of accounts-related information to ensure proper management planning, inspection, control, and screening with a view to take significant decisions regarding the business. It is necessary for this to deliver information known to the team to be pertinent and provided sensibly. This report will conduct a critical analysis of different tools and techniques of management accounting. There will also contain the usage of different management accounting planning tools with examples. Also, strategies for sustainability during a financial crisis will be discussed in the report.

You may feel interested to read below blogs:

Knowledge Management Information System at MC Donald’s

How a Mental Health Nurse contributes to Social Care

Impact of globalisation on health in poor countries

Concept of management accounting

MAS refers to the tactics of scrutinizing and evaluating of costs to help the management position internal financial statement, actions, and account to aid decisions concerning the management of the business (Alawattage and others, 2017).

Management accounting includes the preparation of and providing appropriate financial and details over-the-time data to the key decision-makers to build regular and temporary managerial decisions (Otley, 2016). The system also plays a great role in regulating and controlling the cost structure and expenses.

Evaluation of Management Accounting

It has extraction in the company rebellion of the nineteenth century. During this early period, the bulk of firms was decisively limited by a small figure of owners who borrowed rooted in not public relationships and their personal assets. In the premature fraction of the century, as manufactured goods line stretched operations became further difficult, forward-looking organizations saw a rehabilitated requirement for management-oriented information that was distinct from financial reports. Other than in the majority of companies, management accounting delivered throughout the mid-1980s was mostly identical to practices that were universal before World War I. In current years, conversely, new economic materials have led to several imperative innovations in management accounting.

As a result, for more than a few eras, management accountants have focused more on their dedication to ensuring that numerous requirements were satisfied and financial information was open on point (Pelz, 2019).

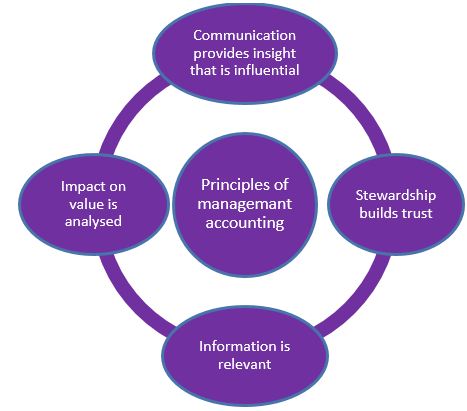

There are four principles of management accounting are

The difference between Financial Accounting and Management Accounting

| Financial Accounting | Management Accounting |

| These are compiled at the end of specific financial terms (usually once or twice a year) | There are made according to the specific needs and aspires of the business organization. |

| Internal and external management. | Internal management. |

| Published and audited. | Neither published nor audited. |

Roles of management accounting system

The most important role that MAS plays is that it conducts relevant cost analysis by which the company come to know the cost structure, areas of costs etc. This information provides a valuable guide to the decision makers to ensure cost control. MAS helps the company to decide on “how to use budget effectively”. Making or bye a decision is one of the most important decisions for any manufacturing company. MAS helps a company to make two scenarios either to make or to buy. MAS helps a company to make the right decision in regard to making or buying. Another important role MAS play is controlling. The system presents an evaluative statement about the performance of different departments, it also shows the company to reduce expenses on the department which is spending more than budget.

It can set up financial techniques by sales predictions, costing, and job-costing methods, along with other decision-making accounting tools. It can be capable of also put in data as business statements to develop strategies that develop profits, net proceeds, and EPS (Weetman, 2019). This moreover, assists in offering particulars financial punishment of decision. Whilst it is important to control the organization’s capital construction, it can create obvious ramifications of accumulating further accountability or equity financing. As per amalgamation with additional companies, chance to unlock the most recent operating amenities or in since immense information of workers. It can make clear the method via which decisions get in touch with statements.

Values and principles of management Accounting

A prominent value of MAS is that it designs and compiles relevant data in the past and present in a convenient format and presents the database to the management so that they can make a decision.

Another significant value of MAS is that it reports on budgetary control, costs which are not as per plan, MAS reports the deficiencies only to the decision makers so that they can take action against the work-going. The advantage of this point is that managers do not need to spend huge time on this job.

Another principle of MAS is that it controls the costs at the source, this means the system make qualitative and quantitative reports on cost at the source when they incur. This ensures better control of costs at the source.

Another principle of MAS is that the system accounts for the rate of inflation in the calculation of return on investment (ROI). It provides a real scenario to the management because the value of money is not stable over time.

Terms in MAS

Management Accounting Systems

MAS is the technique of scrutinizing the costs of an association and management to position internal financial statement, actions, and account to aid decisions concerning the management of the business (Libby and Salterio, 2019). The system provides immense control on the cost control capability of the company through having a detailed and evaluative view of the sot source and structure.

The management of the Inventory System

An inventory Management System (IMS) is a comprehensive system that consists of hardware, software, process and applications that monitor, analyze, evaluate and inform valuable inventory-related data such as stock levels, the value of the stock, ownership of the stock, type of stock etc. (Cooper and others, 2017). IMS also provides a valuable messages to the company regarding when to do production, including the quantity.

Price optimization System

Price optimization is not anything more than the development of shaping the correct retail value of goods or services. Whereas in rule, it may appear that there is not an entire set to judge, together the producer and retail stores offer a huge amount of points making the price better to make sure that the goods will sell rapidly while at a halt making earnings.

Accounting System of cost:

It refers to a complete framework for determining the cost or a product or service. Companies use the framework to determine the cost of a product, find the selling price, evaluate the inventory or determine the profitability. Estimation of accurate costing is of great importance because it will determine the selling ability and profitability as well (Cooper and others, 2017).

The system of job costing:

The system refers to accumulating all the costs and information which are accumulated to execute a certain service or job. The reason for such information is that the costing will be submitted to a shareholder because of reimbursement.

Different approaches for reporting management accounting

It assists company owners and organizations in monitoring its’ general presentation and is established often throughout accounting timing as required. Along with the type of plan and the compassion of the information, the organization may request for reports (Bromwichand Scapens, 2016).

Budget Report

Budget reports assist businesses in observing their organization’s actions, and for a big organization, the business analyzes the portion’s presentation and organizes expenses. The expected budget for the stage is normally based on the specific operating cost from earlier years.

Reports on job costing

The report indicates a specific project regarding cost. They are usually coordinated with an estimation of proceeds; consequently, the business can appraise the task’s achievement. This helps in finding higher-earning places for the business in order that it can stain its tough work there in a position of point and cash on jobs by means of slight profit margins. These are operated to discover operating costs accepted at the same time as the scheme is in enlargement. Consequently, managers can be accurate in several fields.

Cost Report

Cost Reports aid accountants in calculating the expenses of objects that are shaped through raw data. Those data include the expenditure of goods, overheads and additional costs. It is one kind of management accounting report that has to be looked at, précised and utilized for the function of development and observing the profit margins (Becker et al., 2016).

Inventory and production

Businesses with material stock can employ managerial accounting reports to generate their produced procedures well-ordered. Those reports will mainly include the level of inventory of different items, they should also provide information to management about the safety stock of an item and indication that certain products should start bulk production.

Management Accounting Techniques

Cost

In accounting, the cost is about the monetary value that has been exhausted to create something specific and great. Cost means the sum of money that should be spent on the configuration or assembly of merchandise or services (Alawattage and others, 2017).

Classification of cost

A direct cost is a thing that can be attributed to the creation of accurate goods or services. For instance- material, direct labour and other costs. On the other hand, indirect costs to facilitate are not directly connected to an expenditure.

Fixed Cost is an episodic cost that holds unchanged irrespective of the manufacturing level or sales profits. Conversely, variable cost is which alter relating to production number (Otley, 2016).

Costing Systems

The term refers to the specific costing techniques which are followed to maintain the costing (Alamri, 2019). There are different costing systems, such as absorption costing system, marginal costing system etc. Marginal costing refers to the situation which refers to increased cost because of one unit of excess production.

Marginal and absorption costing systems (calculation)

Marginal Costing

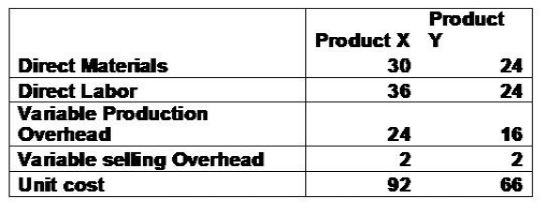

Unit cost

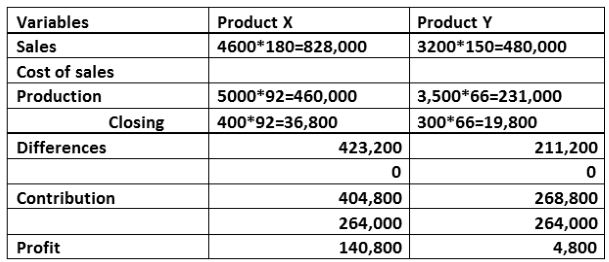

Income Statement (marginal costing)

For March 2019

Absorption costing

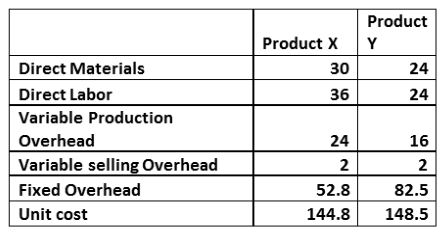

Unit cost

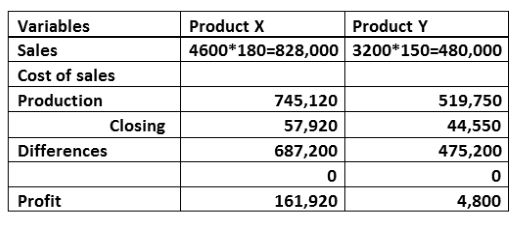

Income Statement (absorption costing)

For March 2019

Conclusion

Management accounting plays through the general decision-making procedure and process of the business. The assistance of management accounting comes from its perspective to notice financial patterns and forecast potential developments. Therefore, it takes into consideration of the general business task. Data accuracy and precision are important to the attainment of each company. Devoid of significant and actionable insights, you can hardly evaluate the present condition of affairs or map the potential organizational moves. In this situation, management accounting considers an anchor of the present business.

References

Alawattage, C., Wickramasinghe, D. and Uddin, S., 2017. Theorising management accounting practices in Less Developed Countries. The Routledge Companion to Performance Management and Control, pp.285-305.

Cooper, D.J., Ezzamel, M. and Qu, S.Q., 2017. Popularizing a management accounting idea: The case of the balanced scorecard. Contemporary Accounting Research, 34(2), pp.991-1025.

Libby, T. and Salterio, S.E., 2019. Deception in Management Accounting Experimental Research:” A Tricky Issue” Revisited. Journal of Management Accounting Research.